Navigating The Pullback With NVIDIA Earnings On The Horizon

Chart: SPY 1-year daily

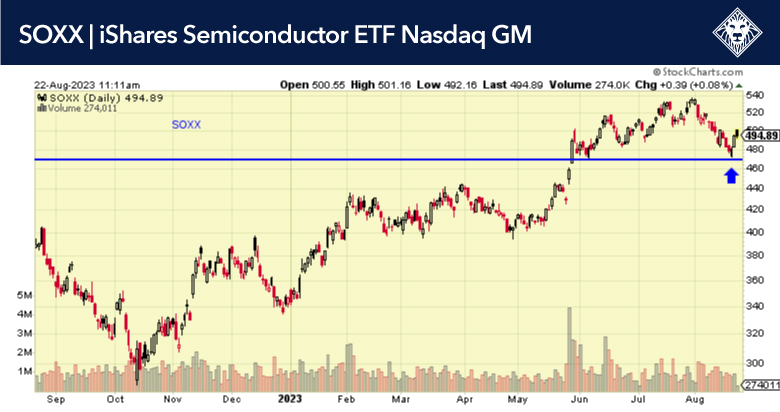

The markets are now oversold with the most recent pullback. As we have said before, all pullbacks should be considered buyable as long as the HCM-BuyLine® is positive, which it is. Semiconductors are looking like they could be a good area to place money; a good ETF is SOXX and of course like we talked about last week AMD and (NVDA) NVIDIA Corp have also pulled back. NVDA reports earnings on Wednesday; this might be one of the most anticipated earnings calls I have seen in a long time. The market has been excited about AI and NVDA is one of the leaders in this area. It could be a volatile market in after-hours trading on Wednesday, so be prepared.

Chart: SOXX 1-year daily

Fed chair Powell speaks at Jackson Hole, which could lead to the short-term sell coming to an end. He will either be dovish or hawkish, but it should make things interesting either way.

Chart: TLT 1-year daily

The 20-year treasury, as seen by the ETF TLT, is looking horrible as far as price goes. Any increase in interest rates has sent the bond market sprinkling down. There was big sell volume in the last few weeks as investors have been dumping intermediate and longer-term bonds fast. This could be a good sign that stocks could find a bottom, as the last time there was this much selling in TLT was 3/20/20 and that was a bottom for stocks.

The Conference Board’s Leading Economic Index (LEI) fell 0.4% in July, matching the consensus. This was its 16th consecutive decline, but also the smallest drop since August 2022. It suggests the near-term outlook for growth remains uncertain but leans toward negative. The Conference Board projects “a short and shallow recession in the Q4 2023 to Q1 2024 timespan.”

Most LEI components either declined or held steady last month. The biggest negative contributions came from falling manufacturing new orders, worsening consumer expectations for business conditions, and higher interest rates. The six-month rate of change of the LEI was near-steady at -4.0% and close to its recent low of -4.6%. The majority of LEI components have worsened over the past six months. The diffusion index inched down to 30% in July, and has been below 50% since March 2022. The widespread component weakness and persistent decline in the LEI are historically consistent with shrinking economic activity.

But that is not evident in the gauges of current economic activity. The Coincident Economic Index shot up 0.4% in July from flat in the prior month. It was its biggest gain since January, led by a rebound in industrial production. The lagging index was practically unchanged. As a result, the Co/Lag jumped 0.4%, up in three of the past five months and by the most since October 2021. In contrast to the LEI, it suggests a trend of improving growth. On a y/y trend basis, it is still down 4.2%, but the negative momentum has eased from earlier this year, as the risk of recession has diminished since then.