The Job Market is Cooling. The Fed Needs to Drop Rates. It’s That Simple.

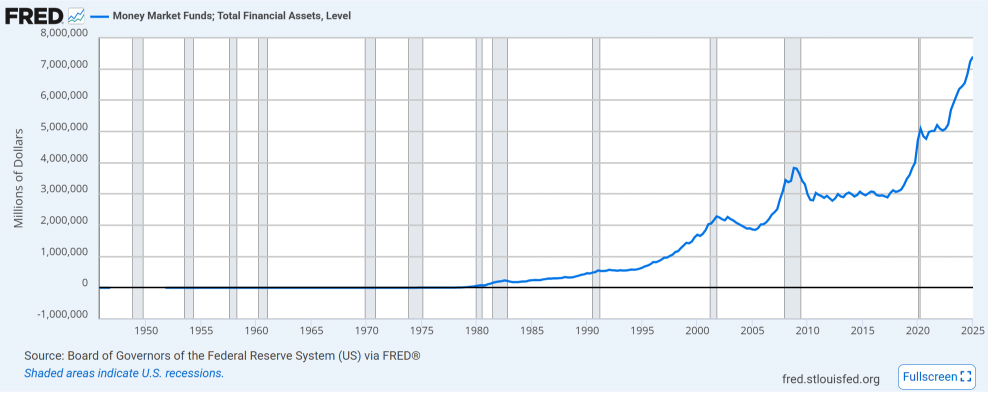

The analysts and economists who are out crying wolf that the sky is going to fall are just about always wrong. Will we have pullbacks and volatility? Of course, markets like to correct and then move higher. But there is $7.4 trillion in money market accounts waiting for any drop in rates, and we should see some of that money moving into equities. The HCM-BuyLine® is positive, and pullbacks should be seen as buying opportunities.

Just as we wrote about last week, the markets like to take what I call “a little Spanish Pause” every now and then. Periods of consolidation are normal and healthy for stocks to move higher.

US equities finished higher in a fairly quiet Monday trading session, with the S&P largely erasing Friday’s selloff (but remaining less than 1% below record highs). Big tech was mostly higher, with NVDA and META among the notable gainers; but market breadth was solidly positive, and the equal-weight S&P only slightly lagged the cap-weighted index.

The Fed is late. They should have dropped rates at the last meeting, and two board members dissented, which is very uncommon. A September rate cut is highly probable in our opinion.

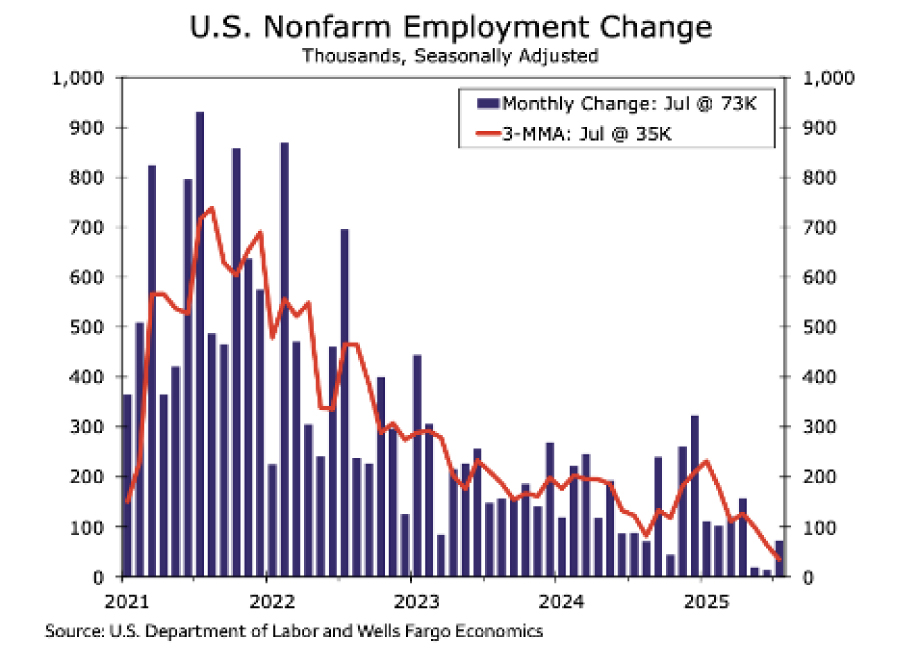

On Friday, we learned that U.S. employers created just 73,000 jobs in July. After May and June’s numbers were revised lower, we learned the three-month moving average was a paltry 35,000. That means the labor market, comprising 159.5 million jobs, is growing by just 0.02% per month.

“Friday’s jobs report, with its below-consensus July reading and very large May and June revisions, reflects a US economy closer to a tipping point than markets or the Fed previously thought,” Nicholas Colas, co-founder of DataTrek Research, wrote on Monday. “Monthly job growth that hovers around zero for a few months in a row is a classic early recession indicator.” Job creation is arguably the most important indicator of economic growth. And it’s not the only metric that’s cooling.

One of the bigger drags to growth has been personal consumption expenditures, which account for 69% of GDP. Real personal consumption peaked in April, and growth has mostly been flat this year. Come on Fed chair Powell, read the data, it is time to drop rates.