Inflation Pressure Eases – Time For The Fed To Cut Rates?

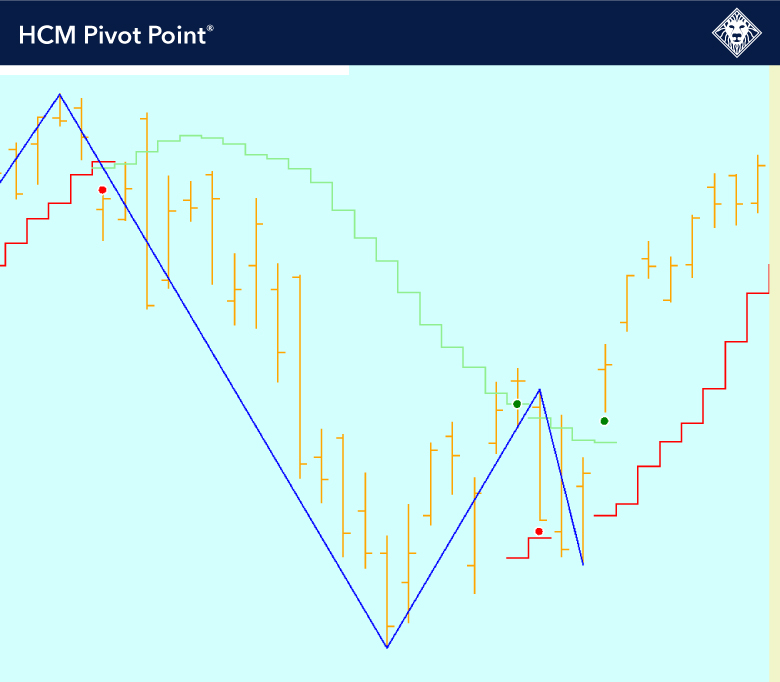

Chart: SPX 1-year daily

The market is about to break out, in our opinion. We expect it to hit resistance at the high set around March 28th, and a small, buyable pullback should take place. Once we break above the March 28th high, look for a nice rally on the breakout.

The HCM Pivot Point® signaled a sell on the very modest pullback we had in April. We reduced exposure to equities by about $1.1 billion, which was then put back on when the HCM Pivot Point® turned back up. All the money we took off was reinvested at a lower price. I’m coming to the conclusion that the HCM Pivot Point® trading system might be the best system we have built. Even with the very shallow pullback it did its job very well in my opinion.

There was a nice print on the CPI this morning as clearly interest rate hikes are working. What does this tell us? Well, we think the most important tell is that the Fed is done raising rates and will hold steady until there is additional evidence that a rate cut is needed. This is very good and constructive news for stocks in our opinion.

April Core CPI came in at +0.29% MoM, below Street consensus of +0.30%. This was a clean “good” CPI reading, with the right components showing a slowdown. The 2 things we watched closely showed improvement: Shelter slowed modestly to +0.38% MoM vs +0.42% last month and auto insurance slowed to +1.76% vs +2.58% last month.

Bottom line: This was a good CPI print and justifies stocks rising into the end of the month. The next key data point is April PCE at the end of the month, which should keep the Fed leaning dovish.