Election and The Bull Market – An Unusual Dance

Chart: SPY 1-year daily

The S&P 500 is in its 11th longest stretch without a 2% down day since 1928. No doubt the market is overbought, but when will it turn, and by how much? We are in a strong uptrend as identified by the HCM-BuyLine® and all pullbacks should be considered buyable, and a pullback is warranted so there should be no surprise when it happens.

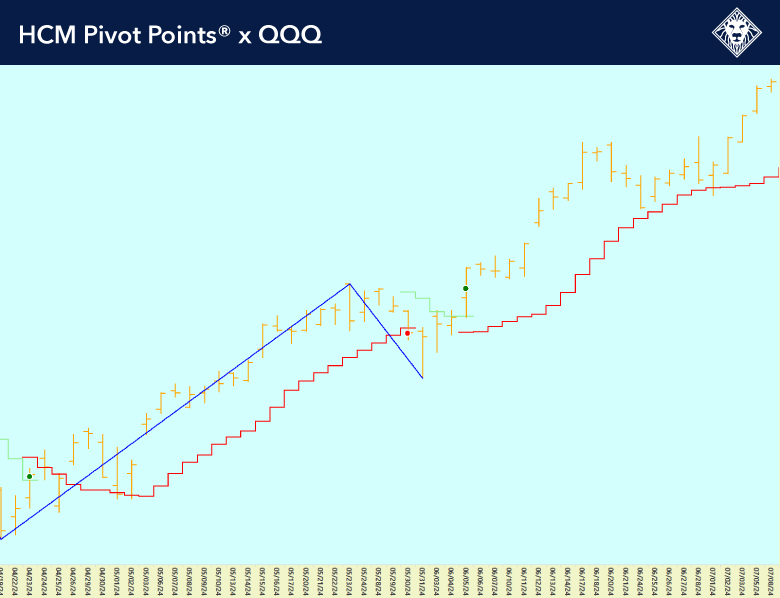

Chart: QQQ x HCM Pivot Points® 3-month daily

This has been a very interesting week after the most disturbing debate, well, maybe ever. They are lining up for President Biden to step aside, but he is clearly anchored in. This is what I find most interesting, in all my years of trading the markets I have never seen this much discord in a political debacle or instability in the leader of the US, yet the market is going up. It has been marching higher almost every day after the debate. I’m not sure what to make of it. In almost all other cases the market has become volatile and usually traded down. All I can make of it is that the markets are OK with Biden stepping down. It would be almost humorous if it was not so serious as to who is leading our country, especially when you have leaders like Xi Jinping, Vladimir Putin, Kim Jong-un, Ismail Haniyeh, and the list goes on of people that would like to destroy us.

The Conference Board’s Employment Trends Index (ETI) resumed its decline in June, falling 0.7% from the prior month and is down 2.1% from a year ago. The ETI has trended down since its peak in March 2022 and is now near its lowest level in over three years. It had generated a signal for slower payrolls growth back in March 2023, which is what has transpired in the payrolls data. Its current level and trend point to further moderation in 2H 2024. The Conference Board, however, highlighted that “net nonfarm payrolls are likely to remain positive,” as long as layoffs remain low. This is in line with our outlook for slower payrolls and economic growth in the coming months.

The New York Fed’s Survey of Consumer Expectations showed inflation expectations mostly easing in June. The one-year inflation outlook came down to 3.0% from 3.2%, while the five-year outlook moderated to 2.8% from 3.0%. The intermediate three-year outlook edged up slightly to 2.9% from 2.8%. Importantly, inflation expectations across all three time horizons have eased significantly compared to earlier in this cycle and have been range-bound so far this year, albeit at higher levels than pre-pandemic.