Two Billion Reasons Why We’re Not Panicking About This Market Dip

Do you want to sell? No, you don’t, you want to buy. It’s time to take advantage and look to start buying some of the most amazing deals I have seen in years.

We are probably sitting on more cash than just about any firm on Wall Street, and we are hungry to take advantage.

The markets are selling off after President Trump’s announcements on tariffs. Like I said yesterday, I had no idea which way the markets would move, or what Trump would say. But today I do, and it has been a lot of selling. Again, the markets are run by algorithms, probably as much as 90% of all trading volume.

When markets behave like this, and it happens from time to time, you must keep your emotions in check.

Here is where we are: We have close to two billion in cash.

HCM Divided Sector Plus is about 45% in cash

HCM Tactical growth is about 45% in cash

HCM Income plus in 35% equites, 35% bonds and 30% cash

QQH is 30% cash

LGH is 30% cash

As you can see, we have a large amount of cash buildup. Of course, when the markets are going down you wish you were more in cash, and when the markets are going up you wish you more invested. Even with a large cash holding, it’s still not fun.

We have our buy list, and we are about to go shopping.

This market will repair itself a lot faster than most think. When the algorithms start buying, and they will, we could see the markets shoot back 10% in just a few days.

On the tariff front: Israel and India pledge no tariffs by April 9.

Canada has issued conciliatory remarks, South Korea plan to negotiate.

Countries in Latin America are seeing mostly a 10% rate.

They are coming to the table fast.

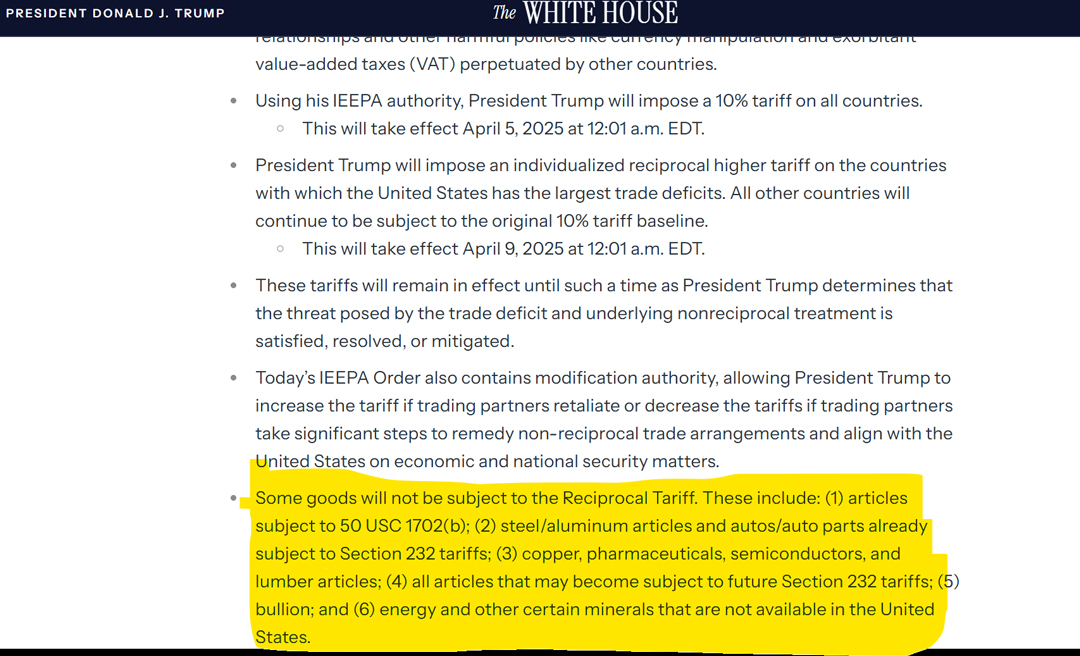

Also, I have enclosed the White House fact sheet from yesterday. There are a lot of exemptions: Copper, pharmaceuticals, semiconductors, lumber articles, certain critical minerals, and energy and energy products.

You think the media might be playing us all….