Dust Off Your Shopping List, BuyLine Still Says ‘Go’

The markets have been pulling back over the last week or so, which looks to be no more than a normal period of consolidation. The S&P 500 and the Nasdaq are both sitting firmly on the 50-day moving average. Pullbacks should be considered buyable as long as the HCM-BuyLine® is positive, so get out your buy list. The markets have now pulled back to the point that they are oversold. Expect the market to continue to consolidate, find its footing, and move higher into year-end.

Investors are trying to process several big factors. The government shutdown, crypto deleveraging, lack of employment and inflation data, and the newly elected mayor of New York City all have people scratching their head.

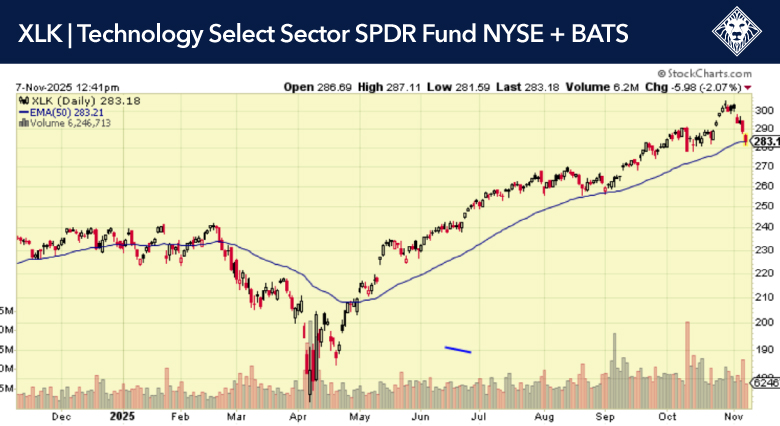

An area to look for opportunities is airlines that are under pressure with the government shutdown. Flights are delayed and cancelled, but this will fix itself soon enough. Another area that looks attractive at current levels is Bitcoin. The Bitcoin ETF (IBIT) has recently sold off and has a lot of liquidity, which makes it easy to make quick moves. Also look at the Technology sector ETF (XLK), as it could be a good way to play the recent pullback.