The Froth Is Gone – An Early Christmas Gift From the Market

The S&P 500 has pulled back to where it should now be considered oversold. It has worked off the froth, and this is good for a year-end rally. Look for resistance in the 6870 area, and with a break above 6900 we should get a nice move higher.

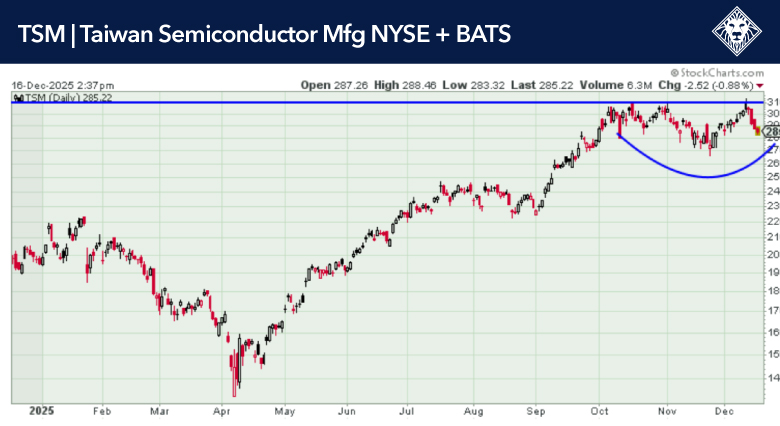

(TSM) Tiwan Semiconductor is setting up for a cup-and-handle, and we think a break above $312.00 would be a good entry point.

Using a simple sum of the median target price of the companies making up the benchmark S&P 500, analysts are predicting that the index will hit 7,968.78 by the end of 2026 — just shy of 8,000 — according to FactSet. That would be a yearly gain of more than 16% based on Monday’s close at 6,816.51.

Looking ahead at 2026, high valuations pose a threat to tailwinds from the Federal Reserve’s ongoing easing cycle, though Fed Chair Jerome Powell mentioned last week that the Fed was in the range of a neutral rate now. The Fed now expects just one rate cut in 2026.

The Federal Reserve cut its key rate by 25 basis points and stuck to its projection of one more cut in 2026. Chairman Jerome Powell surprised with his assessment that payrolls are falling by 20,000 a month, reflecting what the Fed sees as a 60,000 monthly overcount of the official job numbers. He also said inflation would be running close to 2% if not for tariffs. The Fed said it would begin buying $40 billion of short-term Treasuries, but only to smooth monetary policy, not stimulate growth. Markets see little chance of another cut before March. Meanwhile, the central bank reappointed all regional Fed presidents, easing concerns about central bank independence.