Category0

Confusion is the Market’s Kryptonite. Cash is Our Superpower

The market continues to slide but does appear to be gaining a foothold. Are we close to a bottom? The S&P 500 has come down to support around the 4850 area this morning, which should act as support.

No one knows what the plan is from the White House. There is lot of confusion and no real clear end game. Are tariffs here to stay? Is this just negotiations? Has there been any movement towards an agreement? No one knows, and that is the problem the markets are having. I, like everyone else who is watching and reading the news, do not know the answer, and nobody knows what or who to believe.

One thing I do know is that the market will find support, and base and move back up. I can’t say how fast, or when, but this will pass, I’m sure. We have a tremendous amount of buying power to take advantage of when the turn back up happens.

We are about 50% in cash and will be patient as the market finds a bottom. We have our buy list, and we will be prepared to try and find the best opportunities coming out of this selloff.

I wish there was some clarity about all this, but there is not, and again, that’s why the markets are selling off as hard as they are.

Two Billion Reasons Why We’re Not Panicking About This Market Dip

Do you want to sell? No, you don’t, you want to buy. It’s time to take advantage and look to start buying some of the most amazing deals I have seen in years.

We are probably sitting on more cash than just about any firm on Wall Street, and we are hungry to take advantage.

The markets are selling off after President Trump’s announcements on tariffs. Like I said yesterday, I had no idea which way the markets would move, or what Trump would say. But today I do, and it has been a lot of selling. Again, the markets are run by algorithms, probably as much as 90% of all trading volume.

When markets behave like this, and it happens from time to time, you must keep your emotions in check.

Here is where we are: We have close to two billion in cash.

HCM Divided Sector Plus is about 45% in cash

HCM Tactical growth is about 45% in cash

HCM Income plus in 35% equites, 35% bonds and 30% cash

QQH is 30% cash

LGH is 30% cash

As you can see, we have a large amount of cash buildup. Of course, when the markets are going down you wish you were more in cash, and when the markets are going up you wish you more invested. Even with a large cash holding, it’s still not fun.

We have our buy list, and we are about to go shopping.

This market will repair itself a lot faster than most think. When the algorithms start buying, and they will, we could see the markets shoot back 10% in just a few days.

On the tariff front: Israel and India pledge no tariffs by April 9.

Canada has issued conciliatory remarks, South Korea plan to negotiate.

Countries in Latin America are seeing mostly a 10% rate.

They are coming to the table fast.

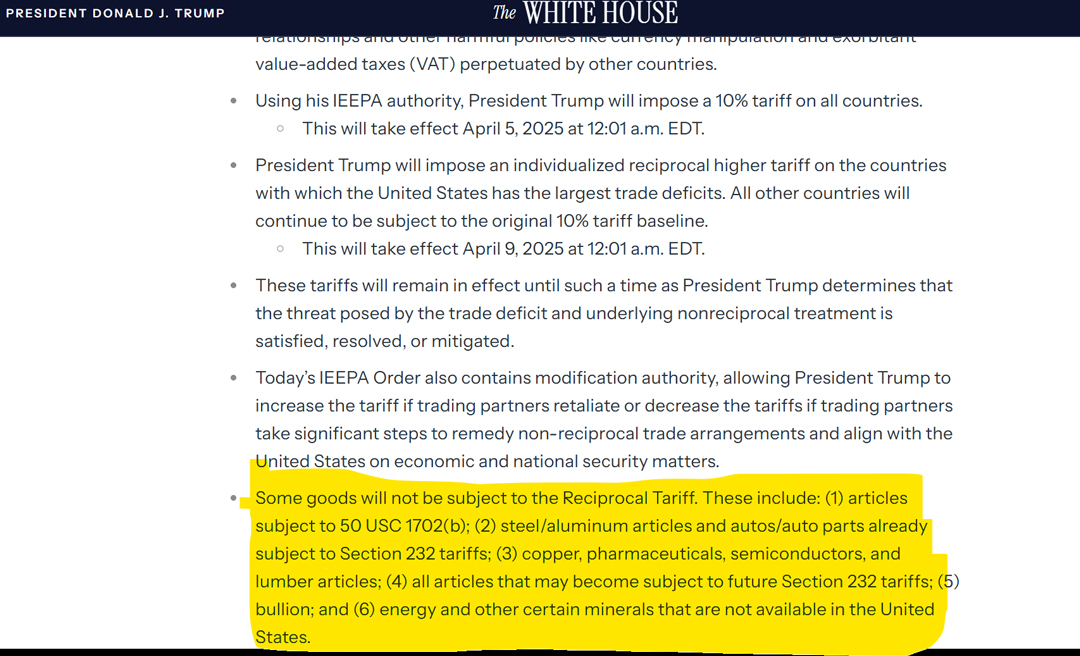

Also, I have enclosed the White House fact sheet from yesterday. There are a lot of exemptions: Copper, pharmaceuticals, semiconductors, lumber articles, certain critical minerals, and energy and energy products.

You think the media might be playing us all….

Tariff-ied? What new tariffs could mean for the markets

Today is when President Trump announces his plan for tariffs. Do I know which way the market will run, NO, and neither does anyone else. But it should be interesting to say the least.

The first quarter is behind us, and what a lousy quarter it was. The 5th fastest 10% correction in 75 years, tech is on its knees, tariffs, tariffs and more tariffs. Next thing you know, as was said in Ghostbusters, “dogs and cats will be living together”. What is an investor to do? Well, get used to it. That is computerized program trading at its best, 85% if not more, of all trading is being done by an algorithm.

So why were the algorithms selling off? Tariffs, no doubt about it. Am I unhappy about it? NOT AT ALL. If we do not take serious measures to control our ever-ballooning debt the first quarter of 2025 will look like a cake walk in the next bear market. If our debt implodes you could see the market drop 50-60% in no time. You say that can’t happen, please review the 2008 financial collapse. We are going to have to take some strong medicine to control our spending and increase revenue.

Reducing spending and increasing revenue are the only two ways for this to happen. And raising tax is one of the reasons we are in this situation, because tax increases have only encouraged our elected officials to engage in even more wasteful spending and not reduce debt.

Let’s play what if.

What if tariffs work? If we are paying 25% in tariff to a foreign firm and we start charging them 25%, what if we both stop charging a tariff? That means 25% stay with our domestic firm, which dramatically increases earnings per share.

What if we can reduce taxes and still pay down our debt?

What if we could drop capital gains tax from 20% to 15%, or maybe even 10%?

I could go on for a long time on the what if game.

But any one of these what ifs could send the market into one of the strongest moves up ever seen. As Tom Lee said the other day, it could be a face ripping rally to the upside.

Now what could go wrong? Inflation, recession or stagflation. So do I know the outcome? No, and neither does anyone else. What I do know is that what we have been doing in the last twenty years is not working, our debt is through the roof and growing to an unsustainable level.

Let’s talk about the market, I think we are close to the bottom as the markets have retested the low set on 3/13. Volatility here is a little bit longer as investors try to wrap their arms around the situation. One thing I do know is this will pass, and a new uptrend will emerge. I’m still holding to my prediction that the S&P 500 will close above 6700 by year end, and I bet nobody even remembers the first quarter of 2025.

Decoding the Downturn: Guide to Current Market Moves

Markets are selling off with the news on PCE, which came in a bit stronger than anticipated. The market looks like it is retesting the lows, which is common before finding a base of support, bottoming, and moving higher.

April 2nd will be a very interesting day. That is the day Trump will announce his plan for tariffs. It’s anybody’s guess what will happen on April 2nd, but no matter the short-term effects this market selloff will pass, and the market will move back up.

U.S. corporate profits jump in Q4

Corporate profits from current production rebounded 5.4% in Q4, the most in two and a half years, as businesses benefited from strong demand at the end of the year. Profits from foreign sources soared 18.8%, the most in nearly two decades. Domestic industry profits rose a smaller 3.6%, led by financials.

Compared to a year ago, corporate profits were up 6.9%, about in line with average growth several years into an economic expansion.

As a share of GDP, profits climbed to 13.5%, a new record high, and a sign that profit margins continued to expand at yearend. The trends for profit and margin growth, however, are facing a downside risk in 2025 from tariffs which are both raising production costs and slowing demand.

The Selloff Playbook: What Past Corrections Tell Us About This One

Quick note:

The market is oversold, but we feel that we may not have seen the bottom yet. We are approximately 40% in cash, and we are looking for opportunities when the HCM Pivot Point® system brings us back into the market.

This is the fifth fastest 10% correction of the S&P 500 in 75 years. Drops like this have a very strong tendency to be a huge overreaction. Big disruptions like we are experiencing with the tariff issue can create big opportunities, and we think this selloff is a big overreaction. If you look back at the other selloffs, they based and moved higher in short order. The stock market was higher at 1M, 3M, 6M and 12M later:

- 5 of 6 times, higher 1M later (except covid)

- 6 of 6 times, higher 3M later, median gain 9%

- 6 of 6 times, higher 6M later, median gain 15%

- 6 of 6 times, higher 12M later, median gain 21%

Selloff Survival Guide: When to Worry, When to Buy

The HCM-BuyLine® turned negative, and we have further reduced exposure to equities. As you will recall, two weeks ago the HCM Pivot Point® was hit, and we reduced exposure by about $1.8 billion. This puts us at roughly 40% cash. Volatility is high, and after making an all-time high on the S&P 500, the market has gone in a straight line down.

Everyone is blaming the market for having a tariff tantrum. The reality is that tariffs are just the excuse, but the fact is that it was a technical selloff. We have not had a real correction of 10%+ in a long time, so it was long overdue. Corrections happen, that is just part of the process of markets moving higher.

So, what is going to happen? We are sitting on multiple billions of cash and yes, we are looking for the market to turn back up and we will be striving to buy some very attractive deals. We still see the market moving higher by year-end, and if we can catch the turn at a reasonable level, we should have a very satisfying year. Selloffs like this come and go, it is just part of the process.

Some will say, why are you so unconcerned? It’s because I have been doing this for about 40 years and the cycle of pullbacks to markets moving back to new highs has happened 100% of the time. The objective now is, can we pick up bargains?

Several economists exacerbated market fears by downgrading their forecasts due to tariff uncertainties. Goldman Sachs notably revised its economic outlook downward. Mark Zandi increased recession probability forecasts from 15% to 35%.

Important economic data this week will be critical for markets.

Tuesday’s January JOLTS report will provide insights into labor market trends, with weaker figures potentially beneficial for market sentiment.

Wednesday’s February core CPI report, with a consensus forecast of 0.30% MoM, will significantly impact market movements; lower-than-expected inflation could reinforce optimism around Fed rate cuts.

Thursday’s core PPI report and Friday’s continuing resolution deadline for government funding add further importance to the week’s events.

Navigating Volatility and Positioning for Opportunity

What a difference eight trading days can make. The S&P 500 came up to reach a new high 8 days earlier only to reverse course with a hard sell off. We were stopped out of several holdings last week and have built up about $1.8 billion in cash. The HCM-BuyLine® has weakened, and we are monitoring it closely to see if further reductions need to be made.

We have gone a long time without a 10% correction, and as we all know, they will happen. Could this be a correction or just a lot of volatility from geopolitical news?

We are oversold, so there could be a relief rally in the making, and we will see if that holds. Even being stopped out, we know the market will turn back up, we just don’t know when and how far it will drop before that happens. Markets need to correct and consolidate from time to time to move up, so this should not be unexpected. Building up cash gives us the chance to look for opportunities as the market stabilizes.

Stocks Hit the Gas and Housing Hits the Brakes — Buckle Up!

Short-term trends are bullish, as SPX and QQQ have finally broken out of their respective triangle consolidation patterns, which had been established roughly three months ago. Both SPX and QQQ made new all-time highs and all-time daily high closes as of Monday 2/18/25. Equal-weighted S&P 500, DJ Transportation Avg., DJIA, and Russell 2000 have not yet achieved the breakout seen in SPX and QQQ, and this will likely take some time.

Accenture PLC (ACN) looks strong as it is starting to break out. Also, Amazon (AMZN) looks like it has pulled back to an area that could be bought.

Housing starts fell 9.8% in January to a lower-than-expected 1.366 million unit annual rate, reversing most of the jump in the previous month. The construction slump was largely due to severe winter weather across much of the country, including in the South region which accounted for more than half of all housing starts last year. Starts fell by double-digits in three of the four regions at the start of 2025, rising only in the West.

Although the weather-related weakness should be temporary, the drop in builder confidence in February suggests that construction activity will likely remain subdued in the near term. Elevated mortgage rates, low housing affordability, and higher costs related to tariffs all weighed on builder sentiment, as discussed in yesterday’s Perspectives.

Building permits, a harbinger of future construction, eked out a 0.1% gain to a lower-than-expected 1.483 million unit annual rate, and were mixed by region.

Both housing starts and permits are off only slightly from a year ago, following deeper declines over the course of 2024. Longer-term trends, however, remain to the downside. On a 12-month average basis, housing starts and permits peaked in 2022 and are now at or near the lows of this cycle. This suggests a continuation of the housing shortage that has been characteristic of the U.S. market since well before the pandemic.