Sector Spotlight – Let’s Talk Financials, Airlines, And Bitcoin

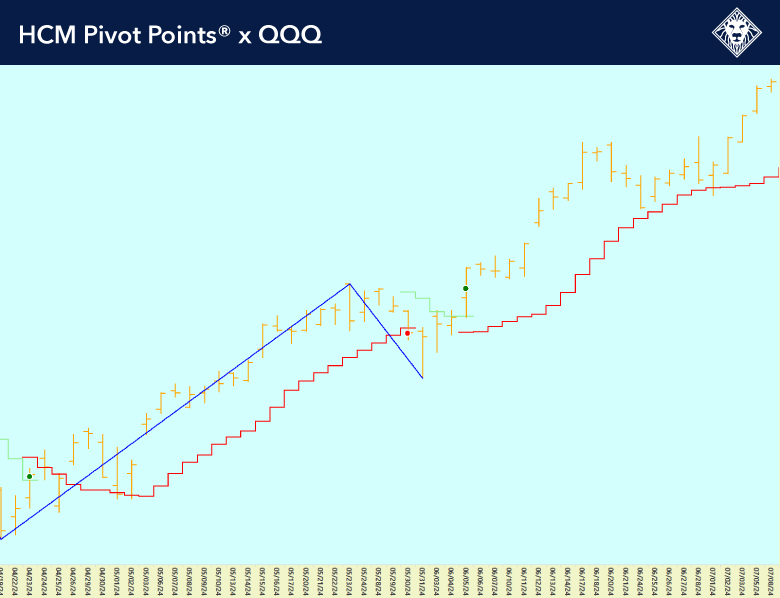

The HCM-BuyLine® is positive, and a pullback should be seen as buyable. We have 18 days left until the election and it’s anybody’s guess as to who will win. Look for the market to either get very slow, meaning not a lot of movement, or on the other hand a lot of volatility as traders and investors try to game the outcome.

Chart: TLT 1-year daily

As the chart shows, the 20-year bond ETF (TLT) has dropped significantly, and a tradable opportunity could be setting up. Rates have risen organically but are now overbought and a snapback rally could be in the making. 10-year yields are responding appropriately to their recent overbought conditions. Remember, overbought conditions in downtrends tend to be more effective than overbought conditions in uptrends, so we like what we’re seeing.

Charts: USB, MS, DAL & JETS 1-year daily

Several positive volatility alerts were triggered in financials on Wednesday, look at U.S. Bancorp (USB) and Morgan Stanley (MS) which are breaking out to the upside. But, we are also seeing some improvement in the airlines with both (DAL) Delta Airlines and the Global Jets ETF (JETS) which are showing positive breakouts from big base formations.

Chart: IBIT 1-year daily

Also, the iShares Bitcoin ETF (IBIT) is trying to move higher. If we can get a breakout above $40/share look for Bitcoin to make a strong move to the upside. If you watch Bitcoin, it will bring out the bullish spirits of a lot of investors and traders when it starts to move higher.