Bullishness Abound – Is It Time To Broaden Out?

Chart: NVDA 1-year daily

Is the market overbought? Yes, but the uptrend is still intact. Is a pullback warranted? Yes, and we will probably have a modest selloff soon. But we do think it will be a buyable pullback as the bull market is still very much alive. Nvidia (NVDA) is all you hear about, which is justifiable, but as Nvidia sells off it looks like the money is going into other areas of the market, which is very bullish. Inflation is dropping and earnings have been very good. There is over 6 trillion in cash on the sidelines, and even with the market moving higher that amount has hardly changed, so there is still lots of buying power to fuel the markets higher.

Chart: SPY 1-year daily

Private sector business activity continued to expand in June, with the S&P Global Flash U.S. Composite PMI edging up 0.1 point to 54.6, its highest level since April 2022. The index is up 2.6 points in Q2, the biggest three-month gain in over a year, a sign of accelerating growth and a tailwind for stock prices

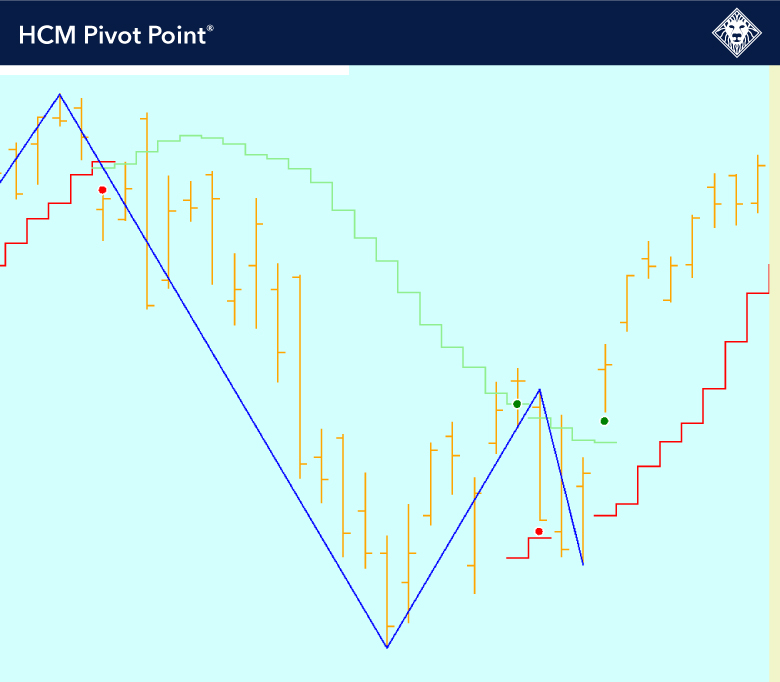

Chart: SPY x HCM Pivot Points® 3-month daily

Both services and manufacturing activity picked up this month. The flash Services PMI rose 0.3 points to 55.1, the highest level in 26 months, and above the consensus of 53.7. New orders rose at the fastest rate in a year, driven by strong domestic demand. Export orders continued to fall, but at a slower pace. Employment increased at the fastest clip in five months. Even so, backlogs rose which suggests that lingering labor supply issues are likely weighing on firms’ operating capacity

The flash Manufacturing PMI rose 0.4 points to 51.7, a three-month high, and above the consensus of 51.0. As in services, new orders and employment rose at faster rates than in recent month. Order backlogs were nearly flat. Output growth, however, moderated.

Existing home sales fell 0.7% in May to a 4.11 million unit annual rate, a four-month low, but slightly better than the consensus estimate of a 4.10 million unit rate. Sales have declined most of the time since late 2021, including in the past three months. There are, however, nascent signs of stabilization. The latest decline was smaller than in the prior two months. Also, sales were flat in three of the four regions, falling only in the South. Compared to a year ago, sales were still down 2.8%, a near-steady rate for the past five months and close to the slowest pace of decline since January 2022.