Investing during the upcoming election and the subsequent presidency

Four years ago, the Democratic party ousted the incumbent Republican party amidst widespread controversy. The media channels and news outlets were rife with rumors and speculative judgements. Today, we stand at the end of President Joe Biden’s first term as U.S. president and elections are looming. In the months to follow, the impending election also means a spate of confusing news that could affect investor sentiment, but it is important to remember that any sort of market volatility will likely be short-lived.

At Howard Capital Management, Inc., we offer insights into key investment trends that can help navigate this evolving landscape.

A Break Down

As things stand, there is no clear lead for either party or their main candidates. It is also important to remember that achieving their policy agendas will depend on cooperation from the U.S. Congress. If the voting public continues to be almost equally divided as it is now, it could happen that neither party will get a majority in Congress, delaying legislative action for policy approval. This inaction could prove to be terminal to any candidate’s presidency.

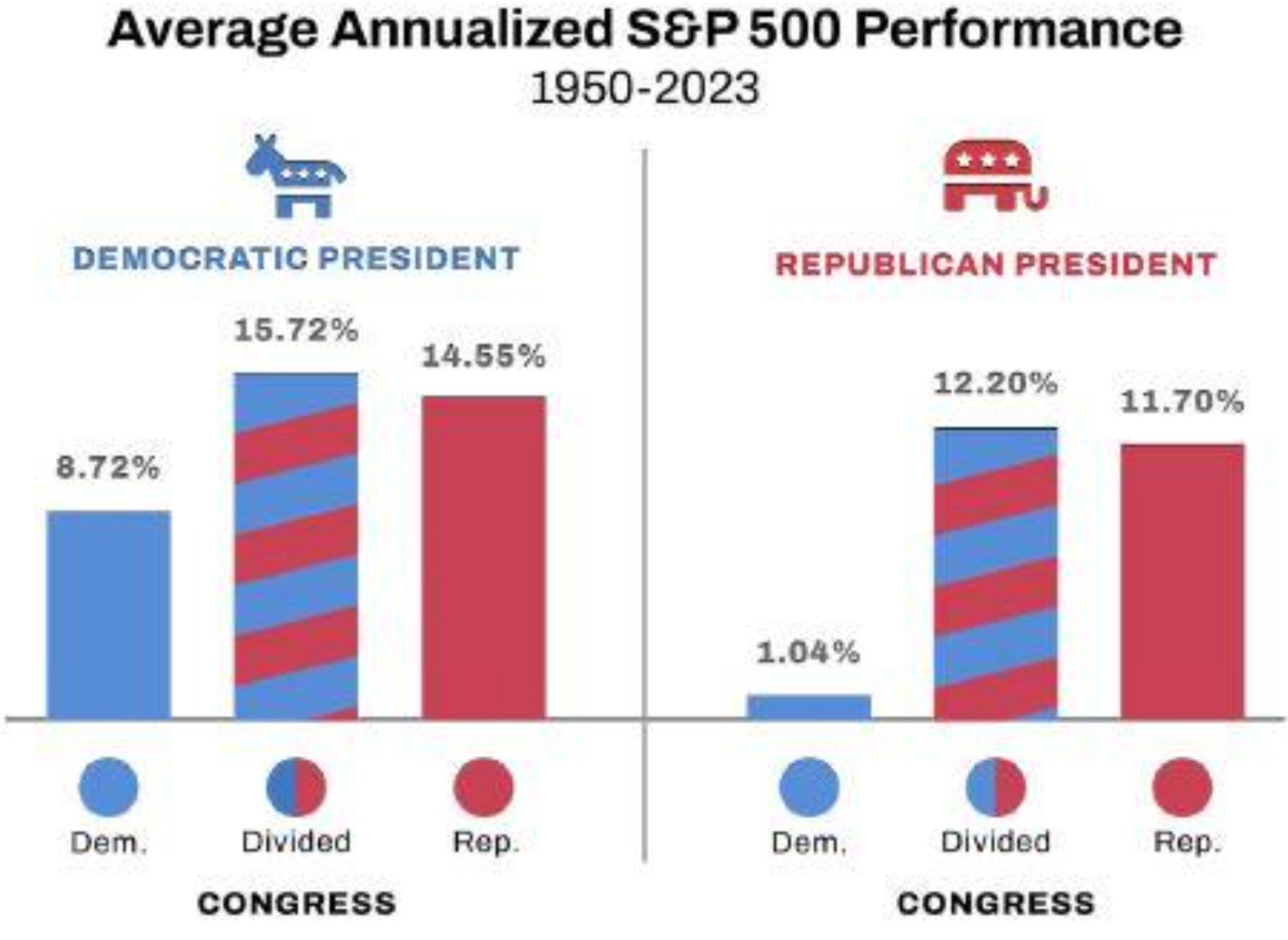

The markets are not immune to such developments. So let us consider some facts. Historically, the equity market has recorded higher gains during Democratic presidencies than in Republican presidencies. Cyclical sectors tend to perform slightly better during Democratic presidencies. The themes for 2024 and the next two to three years are likely to continue in the direction of cyclical sectors with Technology stealing focus the most, while Energy may play an important role in the sustained growth of the U.S. economy. The advancements in AI and the plans to make America self-sufficient in terms of semiconductor production through the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act has gone a long way in supporting the current technology-driven market rally. Those who stayed invested through the current period of high growth could consider whether to keep profits on the table or withdraw given Donald Trump’s promise to reduce the taxes on high earners.

In recent times, Democrats have been pushing for swift reforms to address climate change, whereas Republicans generally favor a more gradual strategy for managing climate-related challenges. Given the potential for a slim majority in Congress for either party, the energy transition is expected to proceed at a slower rate. This slower transition could help mitigate inflationary pressures, providing significant support to the Federal Reserve in its efforts to control inflation. Currently, there is $7.7 trillion in investment earmarked for the U.S. energy sector over 2023-2050 under current policies, which include key incentives enshrined in the bipartisan infrastructure bill and the climate-focused Inflation Reduction Act. This investment would be $1 trillion less if the Republicans win and as promised, they reverse many of the Biden administration’s signature climate policies.

What to look out for?

If Joe Biden wins reelection, infrastructure investment policies are likely to continue as planned, but further extensions are limited by fiscal constraints and the likelihood of a divided Congress. A victory for Donald Trump could lead to significant changes. Republican rhetoric has focused on scaling back aspects of the IRS, targeting green tax credits, and reducing funding for key clean energy programs. However, the popularity of these policies and their benefits to Republican states might limit the extent of the repeal.

Though it is early to predict the election’s macroeconomic impact, investors should consider three factors:

- Deficit Scenarios: Increased government spending may follow the election. A Democratic win could expand the deficit by $450 billion over ten years, mainly from social spending and tax increases. A Republican win might lead to lower taxes and a $1 trillion deficit increase over ten years. However, these changes are unlikely to significantly impact inflation due to restrictive monetary policy.

- Immigration & Inflation: Immigration policies will influence economic growth and resource burdens. The Congressional Budget Office projects steady immigration rates, with minimal inflation impact even if Republican policies change.

- Fed Independence: The upcoming election will determine the next Fed chair. Despite this and the proposal by the Republican party to exercise increased control on the Fed’ decision making, the Fed’s independence is likely to endure, even ensuring inflation control remains apolitical.

According to YCharts, regardless of who is in office, the S&P 500 has consistently grown in value over the long term.

What can I do now?

Knowing that volatility is expected to rise over the coming months, what are investors to do? Our simple answer: Do not make knee-jerk reactions on your own and trust the professionals and systems they have developed to withstand whatever may come to pass. At the end of the day, a contested election result is not a given; a decisive result is also not a given but is certainly possible. The key now is to remain focused on what you can control: your emotions, your strategy, and your goals.

Howard Capital Management, Inc. has seen uncertainty come and go. The only thing we can say for certain is that the HCM-BuyLine® has been aiming to mitigate downturns for clients since 1999, and we will continue to respect and implement its decisions. Regardless of how events unfold, we must be strategic and tactical to bring our best defense against a market that does not think or feel.

Sources:

- Could the 2024 US Election Threaten the Investment Boom? (AXA IM)

- Investors Assess “Trump 2.0” Risks as Election Approaches (Reuters)

- Investment Strategies for the 2024 US Election Cycle (Russell Investments)

- Stock Market Performance Under the Biden Administration (U.S. Bank)

- Study: Trump Win Could Jeopardize $1 Trillion in Clean Energy Investments (India Today)

- How the 2024 Election Could Shape Inflation and Monetary Policy (Morgan Stanley)

- Trump vs. Biden 2024: Election Forecast and Market Implications (U.S. News)

- Presidential Elections and Market Impacts: Historical Guide (YCharts PDF)

HCM-062624-115